Carl and Edith Weeks were dedicated to creating an English manor home that not only looked old but was. Through working with dealers worldwide, the Weeks’ were able to acquire not only antique art and furniture, but entire historic rooms… down to the nails in the floorboards.

One challenge encountered during the construction process of Salisbury House was that certain historical features were not sized for the “modern” (1920s modern) man – i.e., doors. As many history buffs know, our past ancestors were considerably shorter than people today, and thus many of the doors that were sourced from 15th and 16th-century properties were much too short to be used as they were.

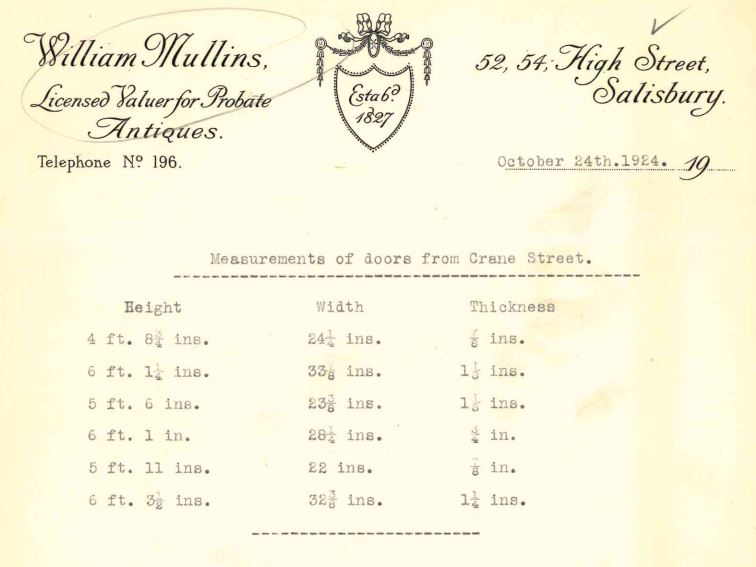

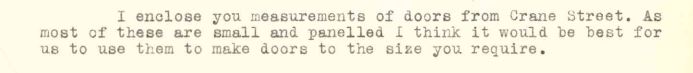

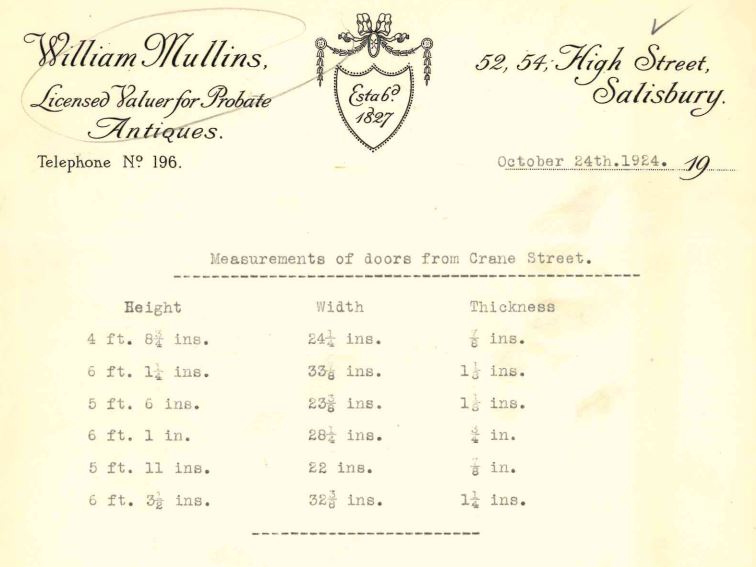

Per a letter from Carl’s antique dealer, Reginald Mullins, dating to October 24th, 1924 –

I enclose you measurements of doors from Crane Street. As most of these are small and panelled, I think it would be best for us to use them to make doors to the size you require.

Measurements of doors from Crane Street –

Height Width Thickness

4 ft. 8 3/4 inch 24 1/4 inch 7/8 inch

6 ft. 1 1/4 inch 33 1/8 inch 1 1/3 inch

5 ft. 6 inch 23 3/8 inch 1 1/8 inch

6 ft. 1 inch 28 1/4 inch 3/4 inch

5 ft. 11 inch 22 inch 7/8 inch

6 ft. 3 1/2 inch 32 3/8 inch 1 1/4 inch

Carl responded:

“We have decided with you that it is best for you to use the Crane Street doors to make doors of the size we require, and measurements will be sent you soon.”

From Mullins, Carl would purchase at least 16 oak doors dating to the 16th century. The purchase price was 125 pounds in September of 1924 – this roughly translates to 7,795 pounds in the modern age and $10,628 in American currency.

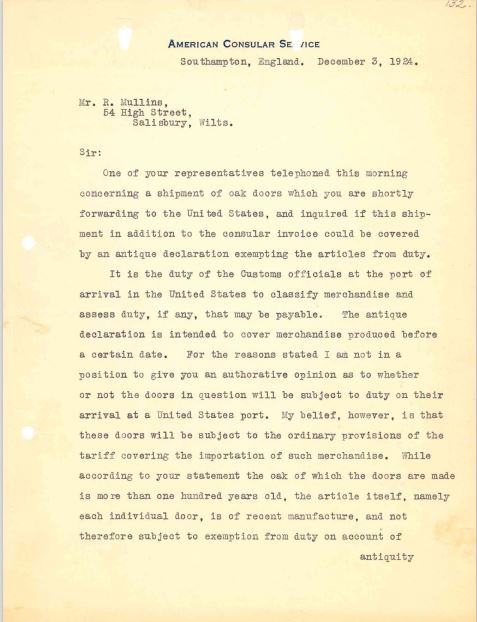

It is interesting to note, as the doors were to be cut down and repurposed for “new” doors, the American Consular declared them to be taxed as new merchandise.

One of your representatives telephoned this morning concerning a shipment of oak doors which you are shortly forwarding to the United States, and inquired if this shipment in addition to the consular invoice could be covered by an antique declaration exempting the articles from duty.

It is the duty of the Customs officials at the port of arrival in the United States to classify merchandise and assess duty, if any, that may be payable. The antique declaration is intended to cover merchandise produced before a certain date. For the reasons stated I am not in a position to give you an authoritative opinion as to whether or not the doors in question will be subject to duty on their arrival at a United States port. My belief, however, is that these doors will be subject to the ordinary provisions of the tariff covering the importation o such merchandise. While according to your statement the oak of which the doors are made is more than one hundred years old, the article itself, namely each individual door, is of recent manufacture, and not therefore subject to exemption from duty on account of antiquity.

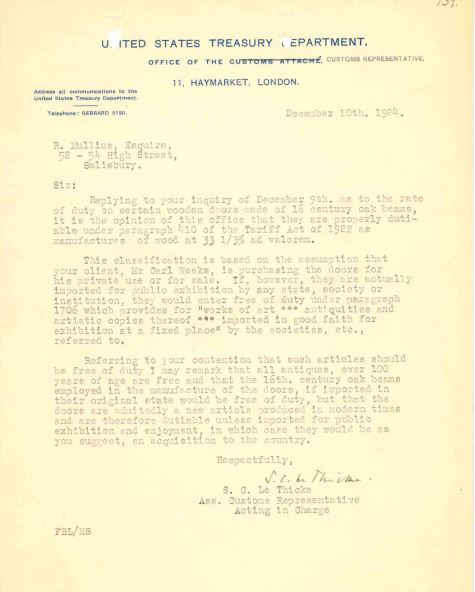

The official ruling came on December 10th, 1924 –

Replying to your inquiry of December 9th, as to the rate of duty on certain wooden doors made of 16 century oak beams, it is the opinion of this office that they are properly dutiable under paragraph 410 of the Tariff Act of 1922 as manufactures of wood at 33 1/3% ad valorem.

This classification is based on the assumption that your client, Mr. Carl Weeks, is purchasing the doors for his private use of for sale. If, however, they are actually imported for public exhibition by any state, society or institution, they would enter free of duty under paragraph 1706 which provides for “works of art*** antiquities and artistic copies thereof*** imported in good faith for exhibition at a fixed place” by the societies, etc., referred to.

Referring to your contention that such articles should be free of duty I may remark that all antiques, over 100 years of age are free and that the 16th century oak beams employed in the manufacture of the doors, if imported in their original state would be free of duty, but that the doors are admittedly a new article produced in modern times and are therefore dutiable unless imported for public exhibition and enjoyment, in which case they would be as you suggest, an acquisition to the country.

Per a letter from Reginald Mullins’ assistant, Arthur Lamb, Carl was informed of the door would be subject to taxes –

“In the absence of Mr. Reginald Mullins we beg to enclose you correspondence we have received from the American Consul at South-Hampton and the Customs Representative of the United States Treasury Department, London, in regard to shipment of oak doors. We thought there might be a possibility of getting them through Duty Free, and you can see we have done our best to do so.”

Carl’s reaction to the news has not survived in our archive, but one can only assume his disappointment.